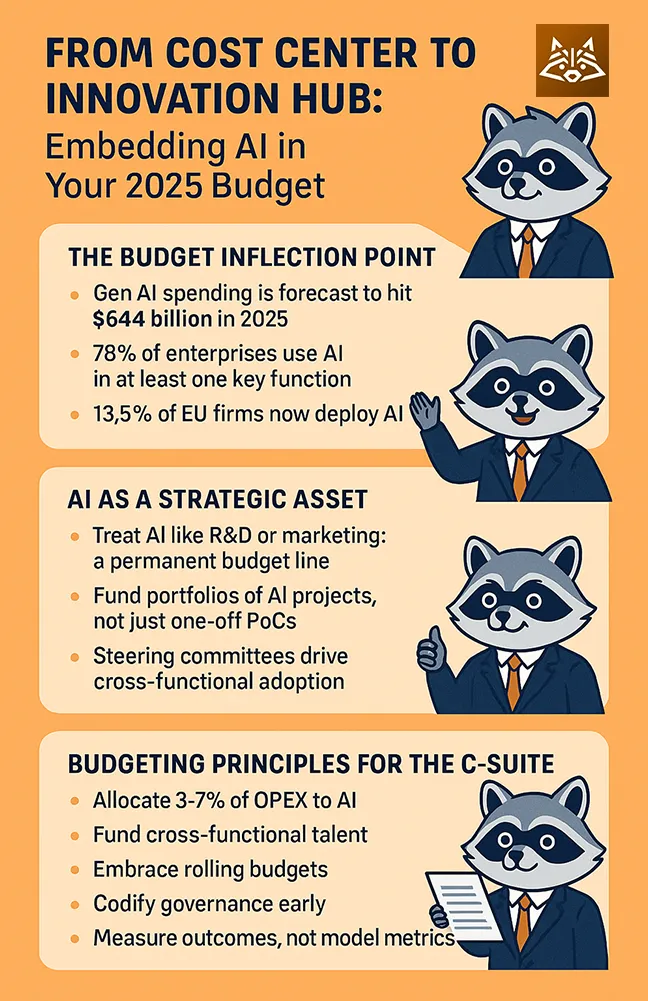

The Budget Inflection Point

When Gartner projects global generative-AI outlays to reach US $644 billion in 2025—a 76 % annual surge—it’s a board-room wake-up call. McKinsey’s latest State of AI survey echoes the shift: 78 % of enterprises now use AI in at least one core function, up from barely half two years ago. Europe’s adoption curve is steepening too; Eurostat records a jump from 8 % to 13.5 % of EU firms deploying AI within twelve months, with German mid-sized companies among the fastest movers.

For CFOs and CIOs, these numbers mean AI budgets are no longer discretionary. They are part of the competitive baseline—much like cybersecurity was a decade ago.

AI Is a Strategic Asset, Not a Gadget

The old framing of AI as a “pilot project” parked in IT is dangerously outdated. Value emerges only when AI funding sits alongside marketing, talent development, and product innovation—governed by the same rigour a board expects from any capital allocation.

In client work, we have found that once AI is treated as a standing budget line, leadership teams stop chasing isolated proofs-of-concept and begin orchestrating portfolios of AI initiatives—from conversational agents in customer service to algorithmic demand forecasting in supply chains. The transformation is cultural as much as technical: cross-functional steering committees, clear product-owner roles, and a bias for continuous deployment replace the PoC graveyard.

A Budget Framework That Turns AI into an Innovation Flywheel

| Budget Pillar | Typical Allocation | Value Levers | Illustrative Results |

|---|---|---|---|

| Data & Cloud Core | 40 – 50 % | Unified data lake, MLOps, secure cloud | 2-3 × faster model iteration |

| Enablement & Governance | 15 – 20 % | Skills programs, risk controls, EU AI Act compliance | 15 % higher model adoption, lower audit risk |

| Applied Use-Cases | 25 – 35 % | Predictive maintenance, dynamic pricing, Gen-AI content | 5-20 % EBIT impact within 12 months |

| Innovation Fund | 5 – 10 % | Rapid pilots, domain-specific agents | Pipeline of new revenue ideas |

Such a split reflects board-level conversations we facilitate at Neoground, weaving regulatory assurance and talent upskilling into the same line items that fund ambitious prototypes.

Early ROI Signals Every Board Should Know

- Predictive Maintenance: Automotive plants deploying AI-driven sensor analytics report 5 – 20 % drops in unplanned downtime, pushing Overall Equipment Effectiveness well above industry norms.

- Generative-AI Marketing: Marketers expect to reclaim five hours a week—or an extra month per year—through AI-assisted content production, accelerating campaign cycles without hiring sprees.

- Data-Centric Finance: Mid-market CFOs using large-language-model copilots cut reporting prep time by 45 %, freeing analysts for scenario planning rather than spreadsheet wrangling (McKinsey field interviews, 2025).

Notice the pattern: returns land fastest where processes are already digital, data is accessible, and change-management muscle exists—an alignment Neoground engineers routinely establish before a single model goes live.

Lay the Digital Tracks Before Running the AI Train

AI rewards the digitally prepared. Clean, well-governed data beats exotic algorithms every time. Boards should therefore view process digitalisation—e-invoicing, IIoT dashboards, unified CRM—as pre-paid AI enablement. Once those tracks are laid, even modest language-model agents can execute tasks end-to-end: parsing invoices, drafting compliance summaries, or autonomously scheduling maintenance windows.

Our advisory work often begins with a data-readiness audit that scores existing systems against future AI ambitions. The exercise surfaces hidden dependencies early, letting finance chiefs ring-fence budget for data plumbing before glamorous use-cases soak up OPEX.

Budgeting Principles for the C-Suite

Before spreadsheets start flying, align on these convictions:

- Allocate 3 – 7 % of OPEX to AI—mirroring mature marketing or R&D spend.

- Fund cross-functional talent: reward data-fluent domain experts; pair them with ML engineers rather than outsourcing all IP.

- Embrace rolling budgets: AI road-maps evolve quarterly; fixed three-year horizons stifle iteration.

- Codify governance early: Audit-ready logs and model cards reduce re-work when regulators—or insurers—knock.

- Measure outcomes, not model metrics: revenue lift, cycle-time cuts, NPS gains, and regulatory risk measured in euros.

When boards follow this playbook, AI costs become predictably linked to growth levers, not hobby-fund lines vulnerable to year-end cuts.

Compliance as Competitive Advantage

The EU AI Act—effective August 2026—introduces risk-tiered obligations that many peers are still deciphering. (see: digital-strategy.ec.europa.eu, investopedia.com). Leaders who design transparency and auditability now will turn compliance into a moat, winning customer trust before laggards retrofit models under pressure.

Having steered several Mittelstand firms through GDPR-style data reforms, we’ve learned that early investment in explainability and traceability pays dividends: shorter sales cycles in regulated industries and smoother cross-border partnerships, especially with U.S. buyers already quizzing suppliers on EU standards.

Leadership Mindset: From Efficiency to Reinvention

AI budgets start with cost-savings narratives, but their real payoff is systemic reinvention. PwC estimates a US $15.7 trillion boost to global GDP by 2030, driven largely by new products and markets unlocked through AI. Boards must therefore cultivate two habits:

- Portfolio Thinking—fund a spectrum of AI bets, balancing incremental wins with moon-shot experiments.

- Learning Velocity—institutionalize post-mortems and knowledge reuse; treat every model deployment as curriculum for the next.

In practice, we see chairpersons moving AI updates from quarterly novelty slots to standing agenda items—signalling that algorithmic innovation sits alongside revenue forecasts and talent retention on the governance dashboard.

Conclusion

Budgeting for AI in 2025 is not about carving off a sliver of leftover IT funds; it is about systematically fuelling innovation. When AI is given a dedicated, auditable share of OPEX, integrated with data foundations and guided by vigilant governance, it acts as a flywheel: converting digital capabilities into compound growth and regulatory resilience.

For C-suite leaders determined to keep their organisations at the vanguard—whether in Frankfurt, Chicago, Dubai, or Singapore—the next budget cycle is the moment to anchor AI at the heart of strategy. Waiting until the technology is “mature” is the costliest decision of all.

This article was created by us with the support of Artificial Intelligence (GPT-o3).

All images are AI-generated by us using Sora.

Noch keine Kommentare

Kommentar hinzufügen